Recently someone asked me for advice on how much equity they should give to their early employees. His company had just closed an early round of funding and he wanted to cement the employee relationships. I gave him similar numbers to what I had been given when I was hiring the first few employees for Standout Jobs. And I told him that the numbers were fairly standard, based on guidelines I had seen used in other places. But I also told him that I though the numbers were wrong.

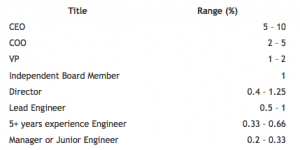

The numbers look quite similar to what is provided by Venture Hacks.

David Crow just posted about this very topic: Founders vs. Early Employees and shows the Venture Hacks chart.

David’s absolutely correct when he writes, “Remember the goal is to incent early employees to have an emotional ownership of the product and company they are building. Equally said, potential employees need to understand what they are getting into.”

But having thought about this for some time, I’m not sure the numbers provided as guidelines above really do incent early employees to have an emotional ownership of the product and company.

This is especially true when you think of a tech startup, where the first few hires are typically engineers/programmers. 0.5-1% is just not a lot. Those first few hires – done correctly – will be so insanely critical for the success of your startup; I believe they deserve more. Those first employees will take 0.5-1% but they’re not going to be overwhelmed by it, or insanely incentivized by that equity alone. Most people know that the chance of a huge, $100MM exit are very slim (where their 0.5-1% is actually worth something!) The people who join startups would all nod their heads reading Dharmesh Shah’s 17 Pithy Insights for Startup Employees. (If not, you better go check them out.)

Paul Graham offers up a formula for the equity challenge, which I think proves the fact that those first few employees deserve more.

I recognize that it’s challenging to give much more than the accepted guidelines on equity to early startup employees. You can’t have an option pool that takes up 50% of the company’s shares, and you have to leave room for future employees as well. And, I don’t believe that anyone joins a startup exclusively (or even primarily) for the equity; if that’s the case, they’re the wrong employee. But nevertheless, I do think that the first few employees – especially those ever-critical developers – need to be more properly incentivized and made to feel closer to founders than employees. As John Cook puts it, great startup cultures are, in part, equity-driven.

The more that those first employees feel like founders in terms of their ownership, emotional attachment, responsibility and overall understanding of the startup process (including financing, running day-to-day activities, etc.) the better the startup will be.

I do believe that early employees should trade salary for equity. And if the equity values increase, it provides more reasonable wiggle room between salary and equity.

Incidentally, for all startup employees (or potential startup employees) I would strongly encourage you to read Chris Dixon’s blog, including this post: The one number you should know about your equity grant. Chris is putting out a ton of great content, and encouraging exceptional debate and discussion on startups and investing.

Founding Partner at

Founding Partner at